By Rebecca Felton

Summary

- We believe the trend for value stocks is uncertain but improving.

- There’s ‘value’ in owning both value and growth stocks, in our view.

- RiverFront has added more value exposure to our portfolios recently as momentum has improved.

Is it time to add to “Value”?

Since June, journalists have written countless articles touting that ‘it’s time’ for traditional value sectors to take the lead after this year’s growth tech-dominated surge in equities. The topic is controversial, partially because there isn’t really a uniform definition of what constitutes a ‘value’ stock. The very existence of the growth versus value paradigm is a long-debated topic on Wall Street. The idea of value is largely credited to Benjamin Graham who is considered the father of value investing. Generally, value investors buy securities that are out of favor with expectations that full valuation will occur at a later date. These securities are viewed as value stocks based on metrics such as price-to-earnings, price-to-book, and high dividend yields for screening. However, we believe sometimes the discounts are for a reason; such as a persistent problem that warrants the discount – in which case the label ‘value trap’ applies. A value trap is a security that is cheap for a reason and continues to underperform.

In a September research paper, Evercore ISI’s Macro Research Analyst Dennis Debusschere noted that the 2020 rotation isn’t about growth versus value, rather it is about ‘Quarantine vs. Recovery and Defensives vs. Cyclicals’. Due to their cyclicality, Value sectors usually coincide with an economic upswing, such as we have already seen. We believe this time has been different due to the pandemic. We have written many times of our long-term preference for growth sectors which we see as beneficiaries of the change in consumer behavior as a result of the pandemic. This has not changed, but we acknowledge that the arrival of vaccines may require a tactical shift.

Don’t fight the trend:

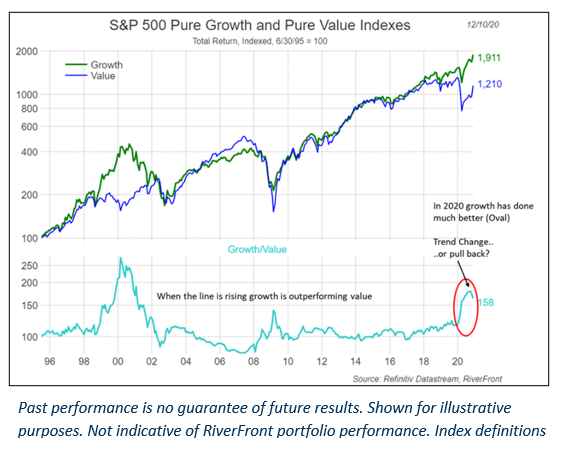

The decision for us is whether the recent downturn in relative performance for growth over value is sustainable (red oval on chart). To do this, we believe investors must look beyond the likelihood of a pending economic slowdown as spikes in hospitalizations and deaths are causing another wave of economic restrictions. If investors are willing to do this, we believe more cyclical value sectors could lead the next phase within global stock indexes.

On November 9th following the news that a vaccine had been successfully developed, the S&P Pure Value index jumped up to its largest one day move in absolute and relative terms relative to the Pure Growth index since the pandemic began in December 2019. We are always willing to respect significant market trends, but for now we believe the jury is still out.

Conclusion

At RiverFront, we believe there is ‘value’ in diversification across both growth and value. We believe that the price you pay for something matters, but we also know that momentum is a powerful force. Both of these dynamics are foundational to our belief in a well-diversified portfolio, regardless of your risk tolerance levels or time horizons. That does not mean that every investor holds all the same asset classes or individual securities, but it does mean that every investor should have allocations across multiple asset classes, regions, sectors and styles – including both ‘growth and ‘value’ – to avoid the anxiety that occurs when they feel they are missing out when one particular group begins to outperform another.

One thing seems certain; “value investing requires deep reservoirs of patience and discipline,” according to hedge fund investor Seth Klarman. Famous ‘value’ investors such as Julian Robertson have been forced to close their strategies due to lack of investor conviction, and even Warren Buffett has had to endure long stretches of underperformance to passive indexes.

In addition to being overweight stocks versus bonds in our balanced portfolios, RiverFront’s most recent trades saw us increase our exposure to some of the value-oriented areas of the market where we had previously taken a ‘show me’ attitude. Our proactive risk management process, based on our tactical view of momentum, pulled us back into these value-oriented sectors.

Originally published by RiverFront Investment Group, 12/14/20

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

The S&P 500® Pure Value index is a style-concentrated index designed to track the performance of stocks that exhibit the strongest value characteristics by using a style-attractiveness-weighting scheme.

The S&P 500® Pure Growth index is a style-concentrated index designed to track the performance of stocks that exhibit the strongest growth characteristics by using a style-attractiveness-weighting scheme.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2020 RiverFront Investment Group. All Rights Reserved. ID 1448259